The Chinese authorities have implemented a strategic shift in the management of the country's foreign exchange reserves, instructing several state-owned banks to reduce their purchases of "U.S. Treasuries" (US government bonds).

The Operative Information Center-OMM reports that this move demonstrates a more cautious stance by official Beijing amid increasing geopolitical tensions and global financial uncertainty. The new directive does not imply a mass sell-off of existing assets but rather focuses on limiting new acquisitions and adopting a more selective investment approach.

For decades, China maintained a significant portion of its trade surplus-generated reserves in US bonds, at one point holding more than $1.3 trillion of these assets. However, as of late 2025, this figure has seen a sharp decline, dropping to approximately $770 billion. To reduce its dependence on US assets, Beijing is actively diversifying its portfolio, increasing investments in other sovereign bonds, infrastructure projects, and gold reserves over the past two years.

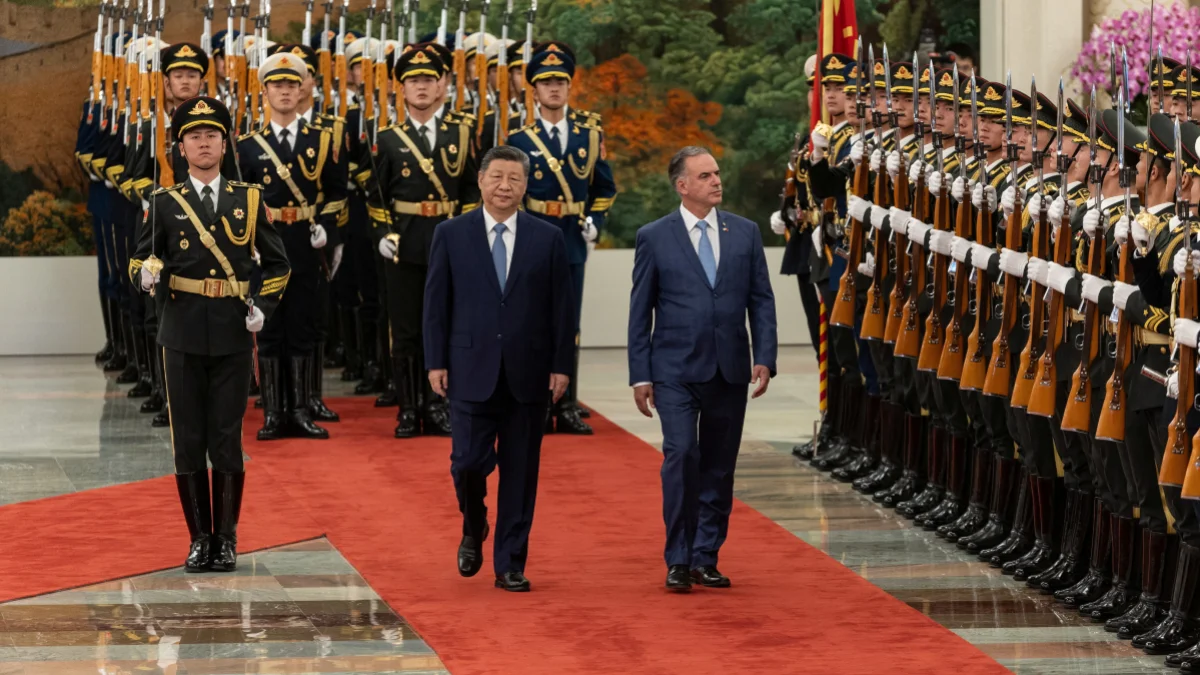

This strategic shift comes at a critical juncture in international relations, particularly following the inauguration of US President Donald Trump in January 2025. Financial analysts suggest that China's move aims to achieve long-term strategic independence and shield its economy from potential external shocks or sanctions without causing immediate volatility in global markets. The diversification strategy reflects a broader trend among major economies to seek stability through a more balanced distribution of foreign reserve assets.